Your FICO Score drops within this a variety, from 740 in order to 799, which can be felt Very good. An effective 750 FICO Score are over the mediocre credit history. Consumers that have score about Pretty good assortment generally be eligible for lenders’ greatest interest rates and equipment has the benefit of.

During the statistical terms, only 1% off people which have Very good FICO Ratings will most likely become certainly outstanding later on.

Improving your 750 Credit history

A great FICO Get away from 750 is actually well above the mediocre credit history out-of 714, but there’s still specific room for improvement.

How you can decide how to switch your credit rating will be to look at your FICO Rating. Along with your rating, you get details about ways you can improve your rating, predicated on specific advice in your credit reports. you will get some a beneficial standard score-update resources right here.

As to why an excellent credit history is quite higher

A credit rating throughout the Decent diversity stands for a verified track record of punctual costs payment and you may a good credit score administration. Later costs and other negative entries on your credit reports was rare or nonexistent, if in case any arrive, he or she is more likely about a couple of years in going back.

People who have fico scores regarding 750 typically spend the bills with the time; in fact, late money appear on just 23% of its credit reports.

Some body like you having Pretty good credit scores is attractive people to banking companies and you will credit card issuers, which normally offer individuals like you greatest-than-mediocre financing words. These may tend to be opportunities to refinance older money on greatest pricing than just you had been capable of getting years ago, and possibilities to create handmade cards with tempting benefits and apparently low interest rates.

Becoming the category together with your Decent credit rating

The 750 credit history means you have been carrying out a great deal best. To eliminate shedding floor, keep an eye on to avoid behavior that can lower your credit history.

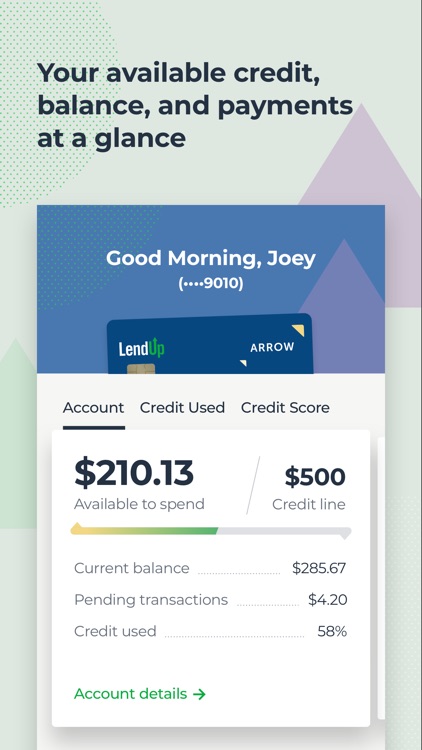

Application rate towards rotating borrowing from the bank Utilization, otherwise incorporate rate, is actually a measure of just how close you are in order to “maxing aside” bank card accounts. You might determine it per of your credit card levels by separating the latest the balance by card’s borrowing limit, after which multiplying of the 100 to obtain a portion. You may want to shape their full application rate from the separating new sum of your card balance by the amount of all cash loan in Jacksonville of the their using limits (such as the limits to your notes and no outstanding balances).

Most it is strongly recommended keeping your utilization prices during the or lower than 31%- into the individual accounts as well as accounts in total-to get rid of lowering your credit ratings. The newest better any of these rates extends to 100%, the greater they affects your credit score. Use rates accounts for nearly one-third (30%) of your own credit history.

Late and you will skipped money count much. One or more-3rd of the get (35%) was influenced by the latest visibility (or lack) recently otherwise missed repayments. In the event the later or skipped money are part of your credit score, possible assist your credit score significantly when you get to the regimen out of paying their bills on time.

Time is on the side. For many who take control of your borrowing cautiously and become quick together with your costs, not, your credit score will tend to raise in the long run. In reality, if the any other rating impacts are the same, an enthusiastic prolonged credit score often give a higher credit history than simply a shorter you to definitely. There is not far can help you to evolve it whenever you are an alternate borrower, except that have patience and sustain with your own expense. Period of credit history is responsible for to fifteen% of the credit history.

Financial obligation composition. The brand new FICO credit scoring system does like several borrowing account, with a mix of revolving borrowing (account particularly playing cards that enable you to borrow on a having to pay restriction and come up with monthly installments of differing wide variety) and repayment money (e.g., car loans, mortgage loans and you will student loans, that have put monthly installments and you will repaired pay periods). Borrowing from the bank blend is in charge of regarding the 10% of credit rating.

Credit software and the newest borrowing accounts normally have brief-identity negative effects on your credit score. When you sign up for new borrowing from the bank and take on more obligations, credit-rating options flag your as being on greater risk of being in a position to spend your own expense. Fico scores shed small amounts when that occurs, but usually rebound in this a few months, so long as you match all of your current payments. The new borrowing from the bank hobby normally lead as much as ten% of complete credit rating.

When public record information appear on your credit history they could features major negative influences on your own credit history. Records such bankruptcies do not come in the credit file, so that they cannot be compared to most other credit-rating impacts within the fee terminology, but they is also overshadow every other activities and you can seriously lower your credit history. A bankruptcy proceeding, such as, can stay on your credit score having a decade. If there are liens otherwise judgments on your credit history, it is to your advantage to repay them whenever possible.

36% People with a great 750 FICO Rating has borrowing from the bank profiles that are included with car loan and you may 33% possess a mortgage loan.

Secure your credit score out-of scam

People with Very good credit scores will be glamorous goals to own term thieves, wanting to hijack the tough-claimed credit history. To safeguard against this options, contemplate using borrowing-overseeing and id theft-safeguards characteristics which can locate unauthorized borrowing hobby. Borrowing overseeing and identity theft safety features having borrowing from the bank lock have can let you know in advance of crooks usually takes away bogus fund during the your label.

Borrowing from the bank keeping track of is additionally useful for recording changes in their credit score. It will encourage one to get it done in the event your score initiate to slide downward, and help your measure improvement as you work towards a beneficial FICO Rating on the Outstanding range (800-850).

Almost 158 mil Personal Safety numbers was basically established from inside the 2017, an increase of more than eight moments the number in the 2016.

Discover more about your credit score

Good 750 credit history is superb, nonetheless it might be better yet. If you possibly could elevate your score on the Outstanding range (800-850), you might end up being entitled to top financing terminology, including the lower interest levels and you may fees, plus the most appealing borrowing from the bank-card rewards apps. An excellent kick off point is getting your free credit report of Experian and you may checking your credit rating to determine the newest specific things you to definitely effect your get the absolute most. Read more on the get range and you will exactly what a good credit score is.