This post is element of our Decisive Self-help guide to Strengthening Modular. This task-by-action article usually direct you courtesy interested in, opting for, and you can obtaining a modular home mortgage to simply help finance their new house.

When capital modular house, financial institutions will topic you that loan that encounters a couple degrees. These are also known as framework-to-permanent financing. Until your home is done and you can receives its finally appraisal, the borrowed funds might possibly be a casing financing. During this time, you will be making notice only costs. Given that residence is done, the borrowed funds will end up a permanent mortgage. At that time, you can easily start making regular money from the complete amount borrowed.

1 Score an excellent Prequalification Guess

Your first step would be to rating an effective ballpark figure to own how much cash possible devote to your brand new domestic. If you give your financial having economic guidance and you may a general credit history, they’ll certainly be capable provide you with an offer to your how much cash they would become happy to lend both you and exactly what the interest rates and costs perform appear to be. That it guess is very low-binding, both for you and the lender.

Step 2 Evaluate Pricing

Score estimates of at the least 3 additional banking institutions to see what variety of cost you can purchase. Actually a change off a good hundredth regarding a percentage area huge difference into the a performance can indicate thousands of dollars along side lives of your loan.

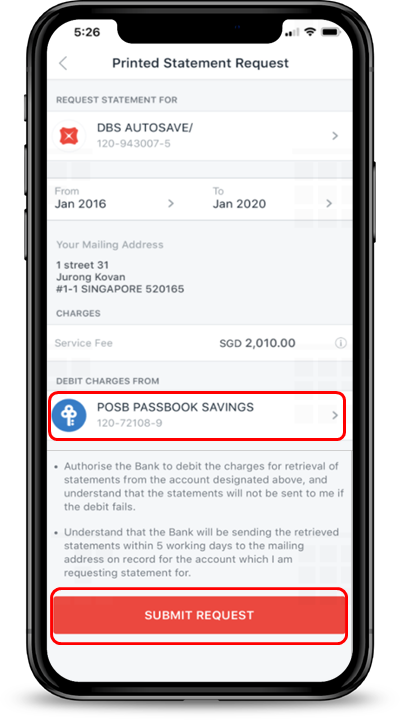

Step three Pertain

Once your think is completed and you may you chosen property to create towards, you will need to apply for the mortgage. To help you incorporate you need:

- The fresh price on brand towards the house you intend so you can get

- Your own W-2s about previous 2 or three years

- Irs Form 4506-T

- Government Tax returns (1040s)

- Reveal account of possessions and expense

- Evidence of a job

- Really works Background for the past five years

- Your latest pay stubs, or if perhaps care about-employed, evidence of money out of a beneficial CPA

- Information on any a great financing

Step 4 Get approved

If the software program is sufficient, the lending company have a tendency to agree the mortgage by the sending your a page out-of relationship. You might have to show that it page to your name brand otherwise so you can a seller when you’re to get property ahead of they’ll indication a final package. Note that inside 3 i mentioned that you’ll you prefer their price for recognized. That it merchandise us with some a capture-22. Neither the financial institution neither producer desires be the first you to imagine one risk, you could make sure they are offer unofficial approvals meet up with the newest concern of your other group.

Action 5 Arranged an excellent Disbursement Schedule

Once you receive finally approval, you’ll need to establish a timeline having Bristow Cove quick loans spending money on the house or property, the manufacturer, all round specialist, and just about every other expenses associated with creating your property. While the for each milestone is actually hit, the lending company will demand proof of achievement, commonly due to an inspection. This will guarantee that only when a role is carried out to help you the bank’s fulfillment usually percentage feel released.

Step 6 Close for the Mortgage

Given that the fresh disbursement schedule might have been put and you will arranged and just about every other questions that they had did you discovered the building permit? was treated, the mortgage is finalized. Both you and the financial institution usually sign the past records and you pays settlement costs.

Step seven Make your House

During the time your house is getting situated, you’re going to be making focus money towards lender monthly. Up to your home is complete, you may not be able to make any repayments up against the concept, very you will need to get home complete as fast as it is possible to.

Step 8 Build your Structure Financing a permanent Mortgage

Shortly after framework has been complete, the lending company will see and you can appraise our house. If everything is sufficient, the loan will become a long-term home loan and you may initiate and then make money up against each other appeal and you may dominant. In the event to date you’d a property loan, the fresh new time clock been ticking in your mortgage as soon as the financing signed. For people who grabbed out a thirty 12 months mortgage therefore grabbed your 90 days to-do design, you’ve got 31 many years and you can nine months kept to spend off of the equilibrium. This could imply that their mediocre commission would be somewhat large a month in order to make up the low level of payment days.